Flood Insurance: Protecting Your Property from Natural Disasters

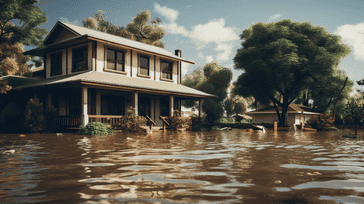

Natural disasters can strike at any time and often result in significant damage to property. While homeowners insurance policies cover several types of damage, they do not typically provide coverage for flood damage. In such cases, flood insurance is essential to safeguard your property and finances.

Flood insurance is a type of insurance policy that offers protection against flood damage caused by natural disasters or other events. This insurance policy covers damage to flooring, walls, and personal property, helping you recover from the financial losses incurred from flood damage.

Insurance is a crucial investment that offers financial protection for you and your loved ones. Various insurance types provide coverage for different aspects of your life, such as car insurance, health insurance, life insurance, homeowners insurance, and auto insurance. Understanding the importance of each type of insurance can help you make informed decisions about your insurance needs.

Car insurance is required by law in most states. It provides coverage for damage to your vehicle and other vehicles, property damage, and injury to yourself and others. You can choose from liability, collision, and comprehensive coverage to protect your vehicle and financial well-being in case of an accident.

Health insurance is essential for covering medical expenses. It offers financial protection against costly healthcare bills, including doctor visits, hospital stays, and prescription medications. Many employers offer health insurance benefits to their employees, and the government also provides options for those who qualify.

Life insurance provides financial protection for your loved ones in the event of your death. It offers a payout to your beneficiaries, which can help cover funeral costs, outstanding debts, and living expenses. You can choose from term life insurance, which offers coverage for a set period, or whole life insurance, which provides coverage for the rest of your life.

Homeowners insurance provides coverage for your home and personal property. It protects against damage caused by natural disasters, theft, and other unexpected events. You can choose from various coverage options, such as dwelling coverage, personal property coverage, and liability coverage, to ensure comprehensive protection for your home.

Auto insurance provides coverage for your vehicle and other drivers on the road. It protects against damage to your car, property damage, and injury to yourself and others. You can choose from liability, collision, and comprehensive coverage to safeguard your vehicle and finances in case of an accident.

When it comes to purchasing insurance, obtaining quotes is an essential step in the process. Insurance quotes provide valuable information on the costs and coverage offered by different insurance policies, helping you make informed decisions about your insurance needs.

Insurance quotes can vary widely depending on the type of insurance policy, coverage limits, deductibles, and additional endorsements. By obtaining multiple quotes from different insurance providers, you can compare prices and coverage to find the best policy for your budget and needs.

Insurance quotes help you understand the details of an insurance policy. They give you an idea of the level of coverage provided, the type of events covered, and the financial impact of the policy on your budget. This information helps you determine whether the policy suits your needs and is financially feasible for the long term.

Insurance quotes also provide an opportunity to ask questions and clarify the terms of the policy with the insurance provider. This helps avoid misunderstandings or surprises when making a claim or renewing the policy.

Most insurance providers offer online tools to obtain quotes for their policies. To obtain a quote, you will need to provide information about the type and level of coverage you require, your personal details, and information about the property or assets you wish to insure.

Once you have provided this information, the insurance provider will generate a quote based on the details you have provided. You can then compare this quote with quotes from other providers to find the best policy for your needs and budget.

Obtaining insurance quotes is an important step in finding the right insurance policy. It helps you understand the details of the policy, compare coverage and prices, and make informed decisions about your insurance needs. By taking the time to obtain and compare quotes, you can find the best policy to protect your assets and provide peace of mind.

Insurance coverage refers to the extent of protection provided by an insurance policy. It defines the specific risks and perils covered by the policy, as well as the limits of compensation that the policyholder can receive for any losses or damages suffered.

Having comprehensive insurance coverage is crucial to safeguarding your finances and assets against unforeseen events. It ensures that you are not left vulnerable to significant financial losses in case of accidents, natural disasters, or other mishaps.

Insurance coverage can vary depending on the type of insurance policy you have. Here are some common types of insurance coverage:

| Type of insurance | Typical coverage |

|---|---|

| Homeowners insurance | Covers damage to your property and personal belongings caused by perils like fire, theft, and some types of natural disasters. |

| Auto insurance | Covers damage to your vehicle and liability for any injuries or property damage you may cause while driving. |

| Health insurance | Covers medical expenses and treatments for illnesses or injuries. |

| Life insurance | Provides financial support for your loved ones in the event of your death. |

Insurance coverage can also include additional endorsements or riders that provide extra protection for specific perils or situations. For example, flood insurance is a type of endorsement that covers damage caused by floods, while earthquake insurance provides coverage for damages from earthquakes.

Comprehensive insurance coverage is essential to protect yourself and your property against significant financial losses. Without adequate insurance coverage, you may be liable for paying out of pocket for damages or losses that occur.

For example, if you have homeowners insurance but do not have coverage for flood damage, you may be left with huge repair bills or even a total loss of your property in case of a flood. Similarly, if you have auto insurance but do not have collision coverage, you may have to pay for repairs or replacement of your vehicle if it gets damaged in an accident.

Having comprehensive insurance coverage can provide peace of mind and security, knowing that you are protected against unforeseen events that may cause financial difficulties.

There are many reasons why flood insurance is essential for protecting your property. With flood insurance, you can rest easy knowing that your home and belongings are covered in the event of water damage caused by floods.

Flood insurance can provide much-needed peace of mind, especially if you live in an area prone to flooding. Knowing that you have adequate insurance coverage can help alleviate the stress and anxiety that often come with natural disasters.

Without flood insurance, you risk having to pay for costly repairs out of pocket in the event of flood damage. With flood insurance, you can avoid the financial burden that comes with rebuilding and repairing your property. Insurance can cover the costs of repairing or rebuilding your home and replacing damaged belongings.

Flood damage can be devastating, destroying your home and damaging your belongings. Flood insurance offers protection against such events, ensuring that you're not left with nothing after a flood.

If you have a mortgage on your property, your lender may require you to have flood insurance. This requirement is to ensure that the lender's investment in your property is protected.

Overall, flood insurance is a smart investment for any homeowner. It provides peace of mind, financial security, and protection for your property and belongings. Make sure to talk to your insurance agent about obtaining flood insurance coverage.

When it comes to selecting the right flood insurance policy, there are several factors to consider. Understanding the coverage options available and your specific needs is crucial to ensuring adequate protection for your property.

When choosing a flood insurance policy, consider the following factors:

It is also essential to evaluate your specific flood risk. Depending on your location and property elevation, you may need to choose a higher coverage limit or deductible.

When comparing different flood insurance policies, it is crucial to obtain insurance quotes from several providers. This will give you an idea of the cost and coverage offered by each policy, enabling you to make an informed decision.

| Insurance Provider | Policy Coverage Limit | Annual Premium |

|---|---|---|

| Provider A | $250,000 | $500 |

| Provider B | $500,000 | $1,000 |

| Provider C | $750,000 | $1,500 |

As shown in the table above, varying coverage limits and premiums can significantly impact the value of a flood insurance policy.

Choosing the right flood insurance policy requires careful consideration of several factors, including coverage limits, deductibles, and additional endorsements. Comparing insurance policies from various providers can also help you find the most cost-effective and comprehensive coverage for your specific needs.

Flood insurance premiums vary based on several factors. Some of these elements are beyond a homeowner's control, while others can be modified to lower premiums. Understanding these factors can help homeowners make informed decisions about their flood insurance coverage.

The location of a property plays a significant role in determining flood insurance premiums. Homes located in high-risk flood zones, such as coastal areas, are more likely to experience flooding and, therefore, require higher premiums.

Properties located in lower elevations and floodplains have a higher risk of flooding. As such, homeowners with properties situated at lower elevations are likely to pay higher premiums.

The Federal Emergency Management Agency (FEMA) designates flood zones based on the level of flood risk in a particular area. Homes located in flood zones with higher flood risks require higher premiums.

The type of foundation a property has can also affect flood insurance premiums. Homes built with basements or crawl spaces are at a higher risk of flood damage. This increases their premiums compared to homes built on slabs.

The amount of coverage a policy offers affects premiums. Properties with higher coverage limits require higher premiums. Homeowners can adjust their coverage limits to lower premiums, but this can leave them vulnerable to costly repairs in the event of a flood.

Insurance policies with higher deductibles typically have lower premiums. However, this means that homeowners will have to pay more out of pocket before their insurance coverage kicks in if a flood occurs.

Homeowners can add endorsements to their flood insurance policies to cover additional risks, such as sewer backups. While these endorsements provide added protection, they can also increase premiums.

By understanding the factors that affect flood insurance premiums, homeowners can make informed decisions about their coverage. While some factors, such as location and flood zone designations, are beyond their control, other elements, such as coverage limits and deductibles, offer homeowners some flexibility in adjusting their premiums. Consulting with an insurance agent can provide further guidance on tailoring flood insurance coverage to meet specific needs and budgets.

If your property has suffered damage from a flood, filing an insurance claim can help you get back on track. Here is a step-by-step guide on how to file a flood insurance claim:

It's important to be aware that flood insurance policies have specific limitations and exclusions. For example, damage caused by sewer backups may not be covered under a standard flood insurance policy. It's important to review your policy and speak with your insurance provider to fully understand your coverage.

Floods can cause significant damage to your property, resulting in costly repairs and disruptions to your daily life. However, there are steps you can take to minimize flood risks and protect your home. Here are some tips:

Remember, while these tips can help mitigate flood risks, they do not guarantee complete protection. It's essential to obtain homeowners insurance and flood insurance to safeguard your property fully.

When it comes to flood insurance, there are often many unanswered questions that homeowners may have. Understanding the intricacies of flood insurance can be overwhelming, but we've compiled a list of frequently asked questions to help clear things up.

Flood insurance is a type of insurance policy that covers damages resulting from floods. This type of insurance is not typically included in a standard homeowners insurance policy, so it's important to obtain a separate policy if you live in a flood-prone area.

Anyone who lives in an area prone to flooding should consider obtaining flood insurance. This includes homeowners, renters, and business owners. Even if you don't live in a high-risk area, floods can happen anywhere, so it's best to be prepared.

The cost of flood insurance varies depending on a number of factors, including the location of your property, the type of coverage you need, and the amount of coverage you desire. On average, flood insurance policies cost around $700 per year.

Flood insurance typically covers damages to your property and belongings caused by flooding. This includes damages to your home's structure, electrical and plumbing systems, and personal belongings.

Flood insurance policies typically do not cover damages caused by sewer backups, mold and mildew damage that could have been prevented, or living expenses incurred while your home is being repaired.

Yes, renters can obtain flood insurance to protect their personal belongings in the event of a flood. Landlords are not responsible for obtaining flood insurance for their tenants, so it's up to renters to obtain their own coverage.

To file a flood insurance claim, you must first contact your insurance provider. You will need to provide documentation of the damages, including photographs and a detailed inventory of the affected items.

If your property is located in a high-risk flood zone, you should definitely consider obtaining flood insurance. In fact, if you have a mortgage on your home and live in a high-risk area, your lender may require you to obtain flood insurance.

Yes, flood insurance can be well worth the cost, especially if you live in an area prone to flooding. The peace of mind that comes with knowing you're protected in the event of a flood is invaluable, and can save you from significant financial losses.

In conclusion, securing flood insurance is crucial for protecting your property and providing financial security in the event of a flood. As this article has highlighted, understanding different insurance types, obtaining quotes, and choosing the right coverage are essential steps to ensure adequate protection.

While flood insurance may come at a cost, the benefits of having it far outweigh the potential consequences of not having it. It can provide peace of mind and protect your investment, saving you from costly repairs and property damage.

Remember, taking necessary steps to mitigate flood risks, such as improving drainage systems and investing in flood-resistant materials, can also help minimize potential damage and protect your home. Don't wait until it's too late; safeguard your property with flood insurance today.

Flood insurance is a type of insurance coverage designed to protect your property from water damage caused by floods. It provides financial protection against losses resulting from flood-related incidents.

Flood insurance is typically not mandatory unless you live in a high-risk flood zone and have a mortgage from a federally regulated or insured lender. However, it is strongly recommended for all homeowners, as floods can occur in any location.

Flood insurance covers structural damage to your property and its foundation, as well as damage to essential systems, such as electrical, plumbing, and HVAC. It also provides coverage for personal belongings, including furniture, appliances, and clothing.

The cost of flood insurance varies depending on several factors, including the property's location, flood zone designation, and the coverage limits you choose. It is best to obtain insurance quotes from multiple providers to get an accurate idea of the cost.

Yes, you can purchase flood insurance even if you don't live in a designated flood zone. Flooding can occur in any area, and having the coverage can provide valuable financial protection in case of unexpected flooding.

Typically, flood insurance policies have a 30-day waiting period before they take effect. It is important to plan ahead and purchase the policy well in advance of any anticipated flood events.

No, flood insurance is not typically included in standard homeowners' insurance policies. It is a separate policy that needs to be purchased specifically for flood coverage.

Yes, renters can purchase flood insurance to protect their personal belongings from flood damage. The coverage is similar to that of homeowners' flood insurance policies.

To file a flood insurance claim, you should contact your insurance provider as soon as possible. They will guide you through the claims process and provide the necessary forms and documentation requirements.

There are several steps you can take to minimize flood risks, such as improving drainage systems around your property, elevating electrical systems, and using flood-resistant materials. It is also important to stay informed about local flood warnings and be prepared for emergencies.